English, Hindi, Hinglish, Arabic and many more.

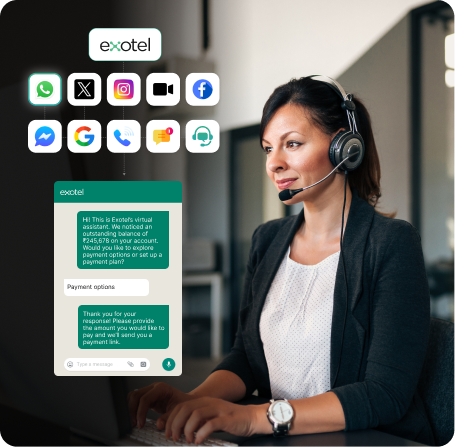

SMS, RCS, WhatsApp, Viber, In-App Calling, and WebRTC.

Preview, Progressive, Predictive, and Blended Auto-Dialers, Chat, Voice, Social Media, Video, and Co-browse.

Cloud telephony, digital voice, SMS, WhatsApp and more.

Debt-collection is tricky but it doesn’t need to be stressful. With Exotel, debt collection becomes a more efficient, personalized, and data-driven process that benefits both you and your customers.

Streamline your collections process with automated notifications and follow-ups via messaging, voice, and other channels. Maximize efficiency while ensuring effective, timely communication with customers.

Build trust through hyper-personalized conversations. Craft customized messages, offer flexible payment solutions, and provide support that strengthens customer relationships, fostering loyalty and long-term value.

Gain actionable insights for customer segmentation and easily deploy tailored multi-channel strategies for enhanced results.

Stay ahead with continuous performance monitoring via robust dashboards & reporting tools. Track key metrics, assess collection progress, and adjust strategies on the fly to drive improved outcomes.